Everything You Need for AML Compliance

We combine deep regulatory expertise with cutting-edge automation

Cut Costs

Eliminate manual tasks and streamline regulatory reporting for PCMLTFA, BSA, and more.

Empower your team with compliance-ready intelligence and reclaim time to focus on your core business.

See it Work

Platform Overview in 20 Seconds

Accelerate Growth

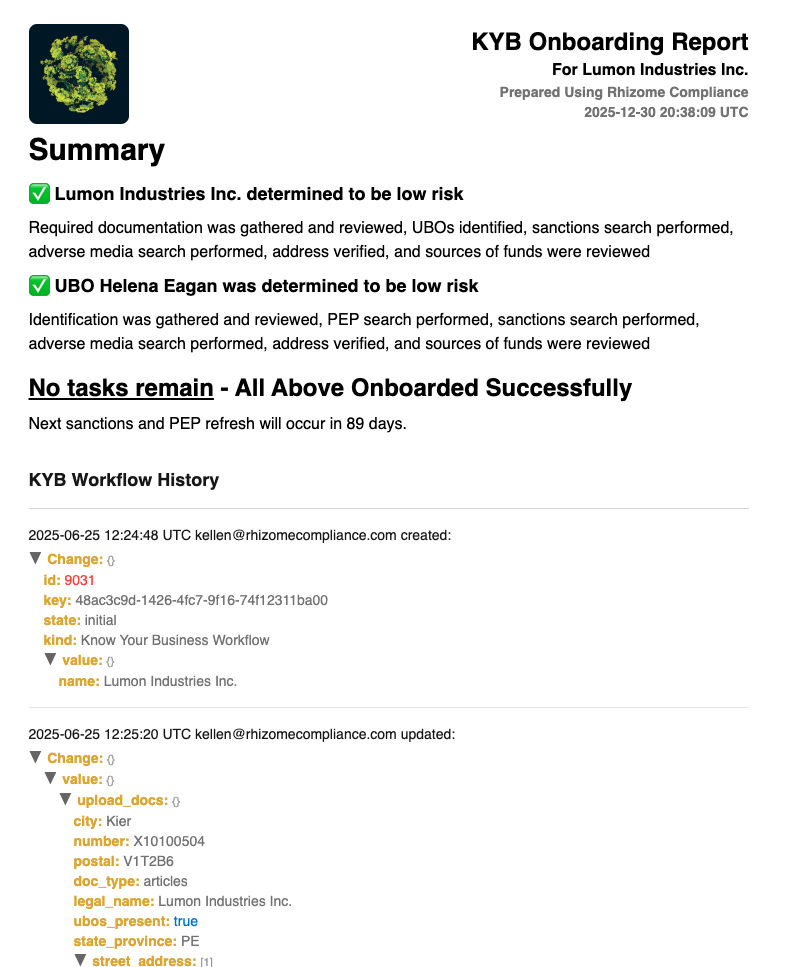

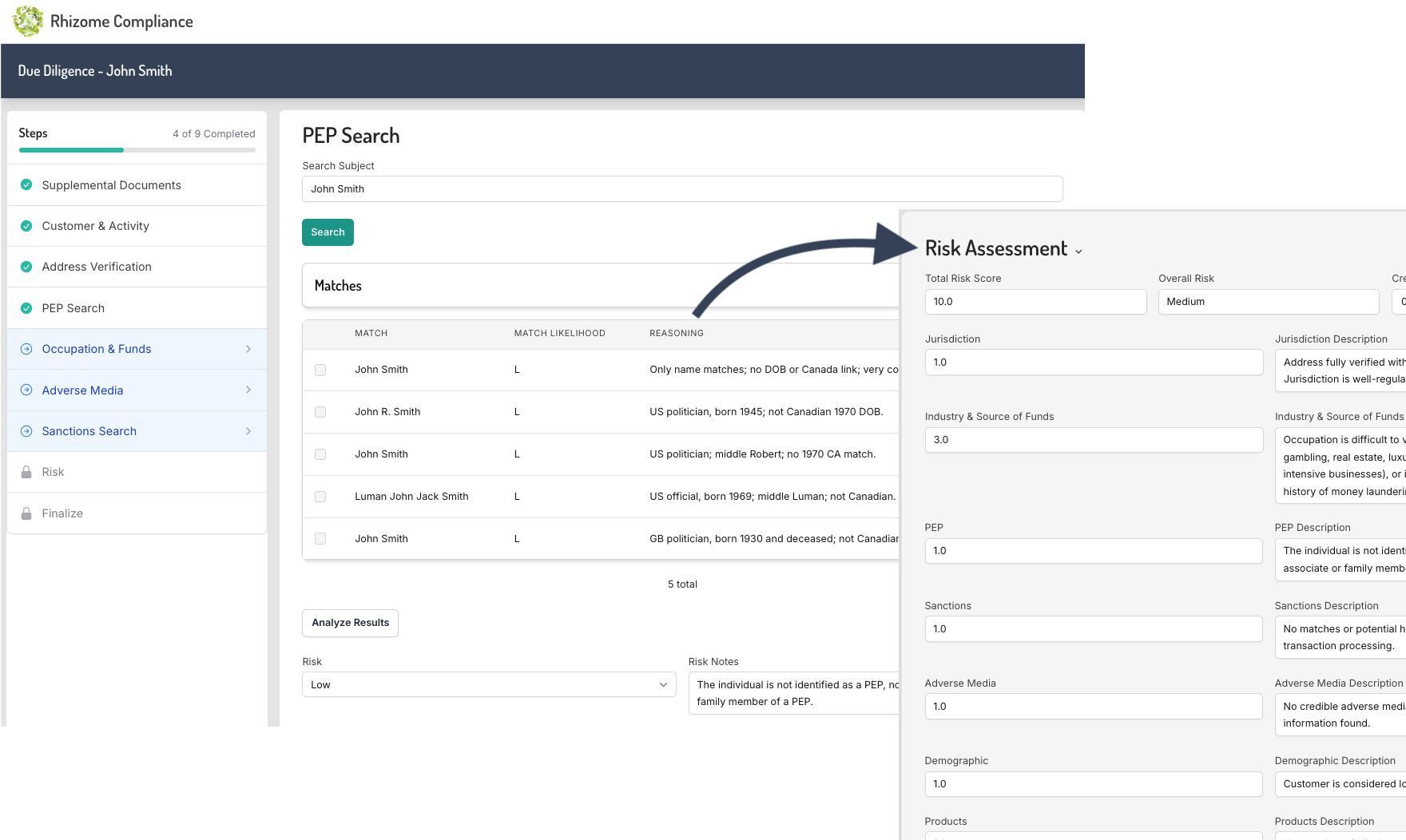

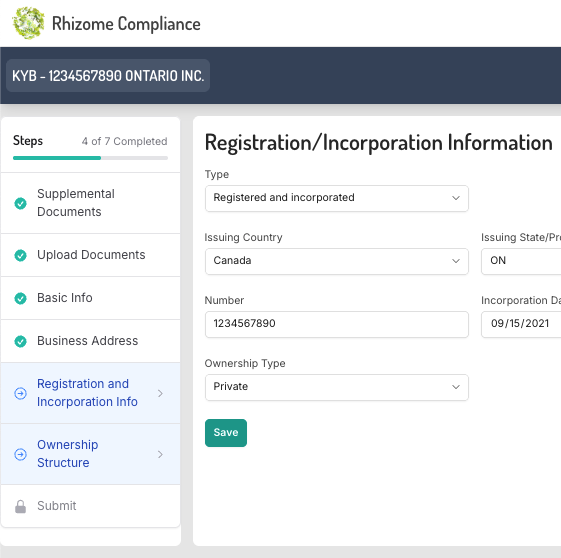

Verify Customers in Seconds

Gather and retain all required data for a compliant Know Your Customer or Know Your Business program.

Integrate instantly with existing tools like your CRM or ID provider.

Use advanced algorithms and liveness checks to prevent onboarding fraud.

Automate continuous due diligence with smart refreshes and reminders.

Prove compliance with detailed, automated reports.

If you use our other services like monitoring or filing, talk to us about getting KYC for free!

Reduce Risk

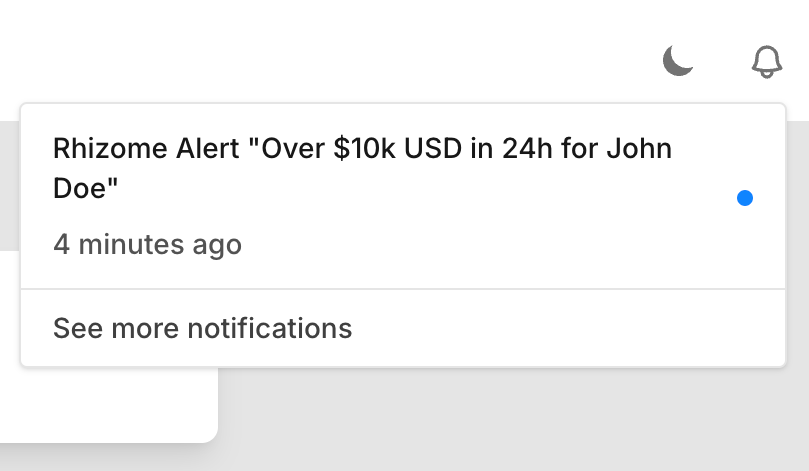

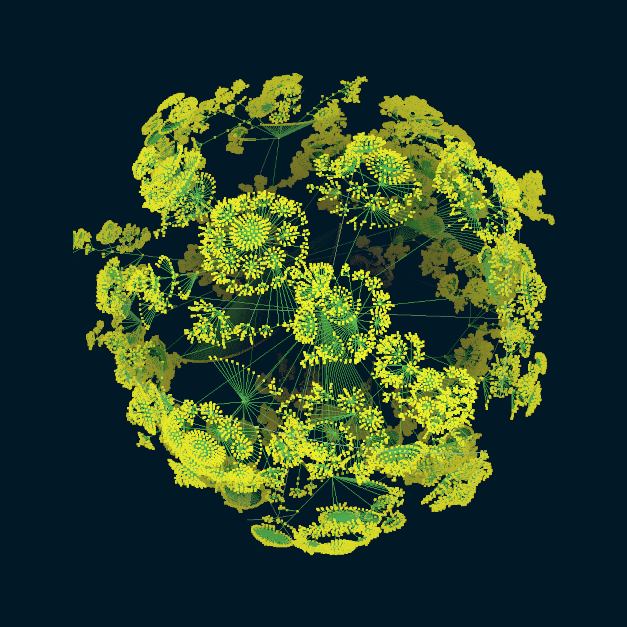

Monitor Transactions and Conduct Ongoing Assessments

Integrate data from any source like APIs, spreadsheets, or smart forms.

Combine rules-based transaction detection with AI insights  to identify evolving threats.

to identify evolving threats.

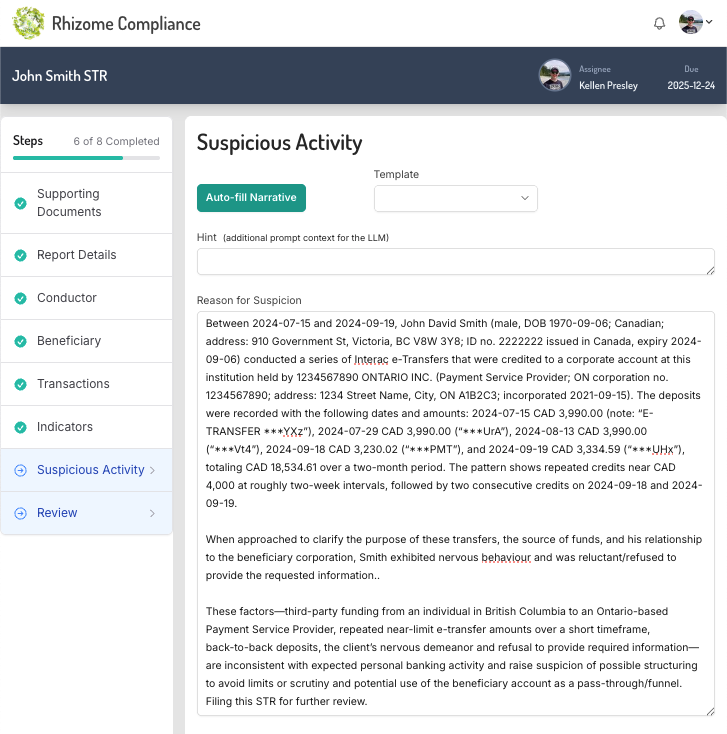

Triage alerts efficiently and pre-fill reports for regulators.

Expand into new markets effortlessly with our universal, future-proof framework.

Reports Filed

Jurisdictions Implemented

Efficiency Gain through Automation

Cut Costs

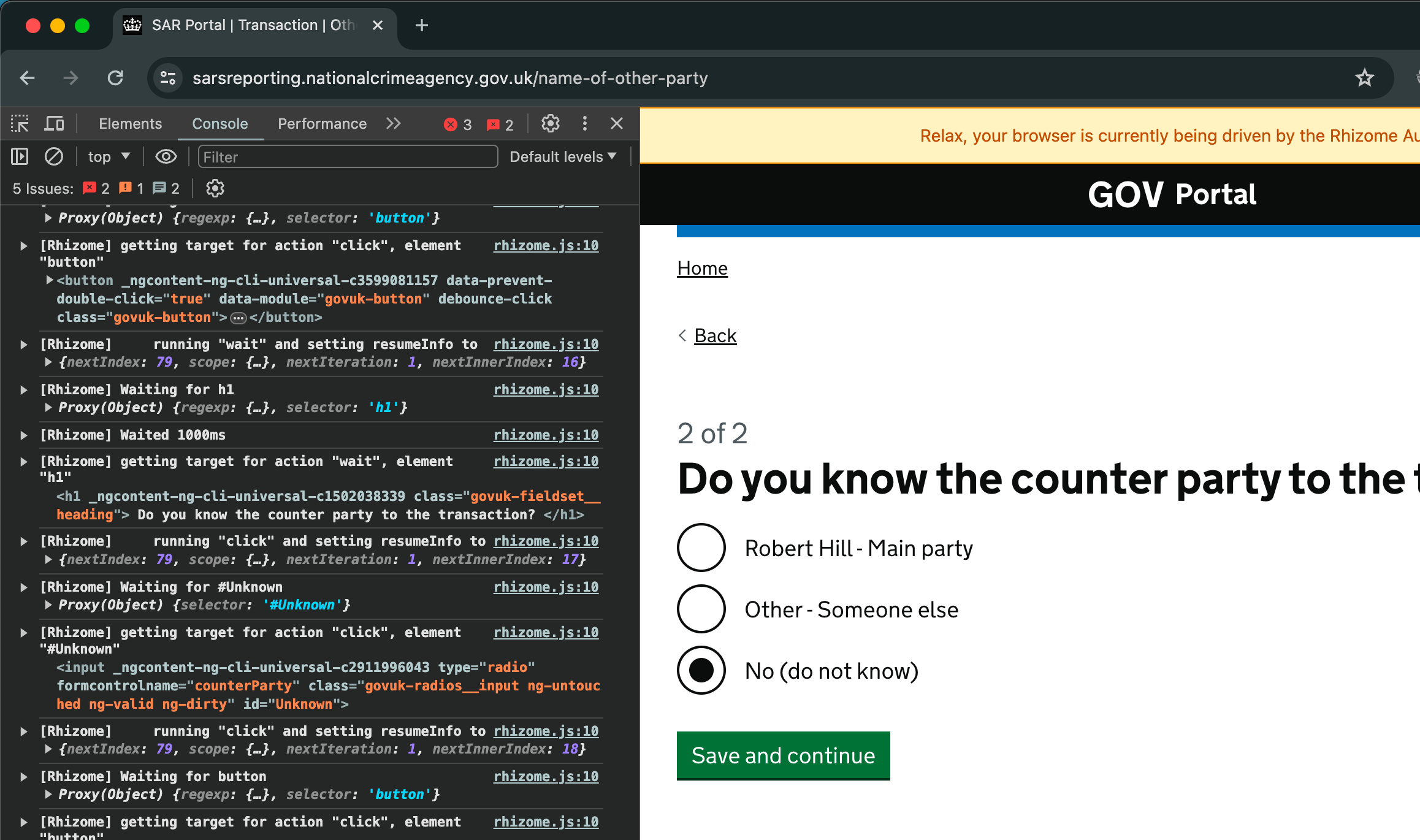

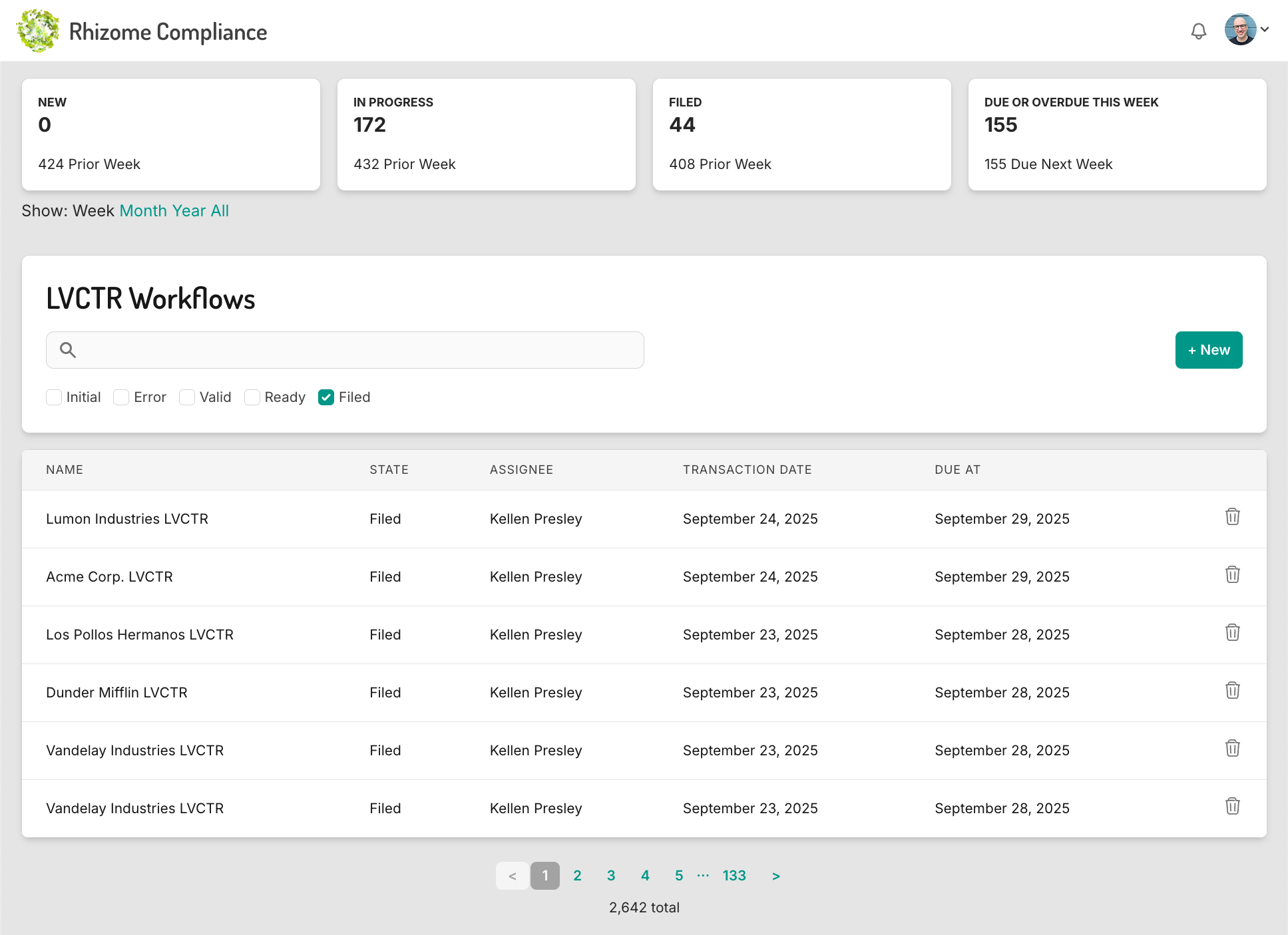

Streamline Workflows and Automate Filing

End-to-End Automation

Standardized workflows ensure compliant, audit-ready processes for every case, avoiding expensive errors and rework.

Investigative Assistance

Automate expensive labor and use AI to help ingest data and produce complex case reports in seconds.

Our Team's Experience

Automate Financial Crime Compliance

We speak FinCEN, FINTRAC, NCA, AUSTRAC, goAML, and we're constantly adding new reports.