Streamline Know Your Business (KYB) Compliance

Automate business verification, UBO identification, and risk assessment

Onboarding business customers is complex and time-consuming. Rhizome's KYB solution automates the entire process, from initial verification to ongoing monitoring, allowing you to onboard businesses faster while strengthening your AML/CFT compliance and reducing risk.

A Complete, Automated KYB Workflow

Verify entities, uncover ownership, and assess risk in seconds.

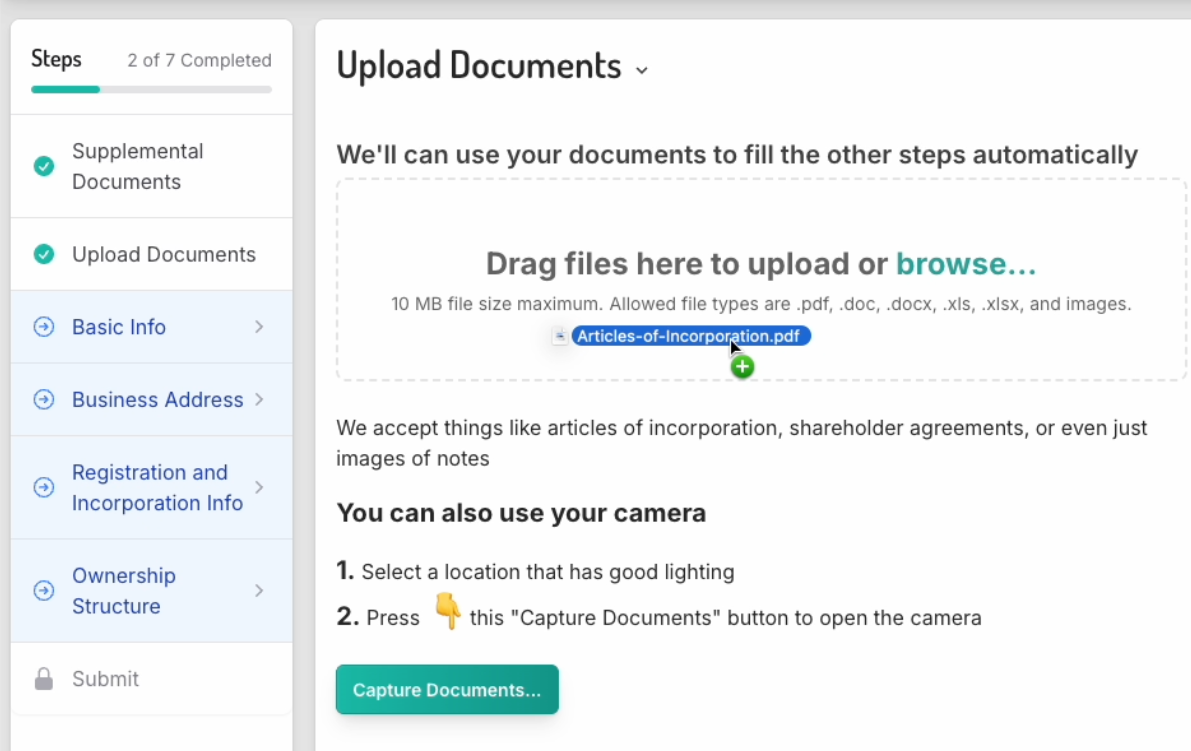

Verify Businesses

Instantly verify company details. Automate the collection and validation of incorporation documents.

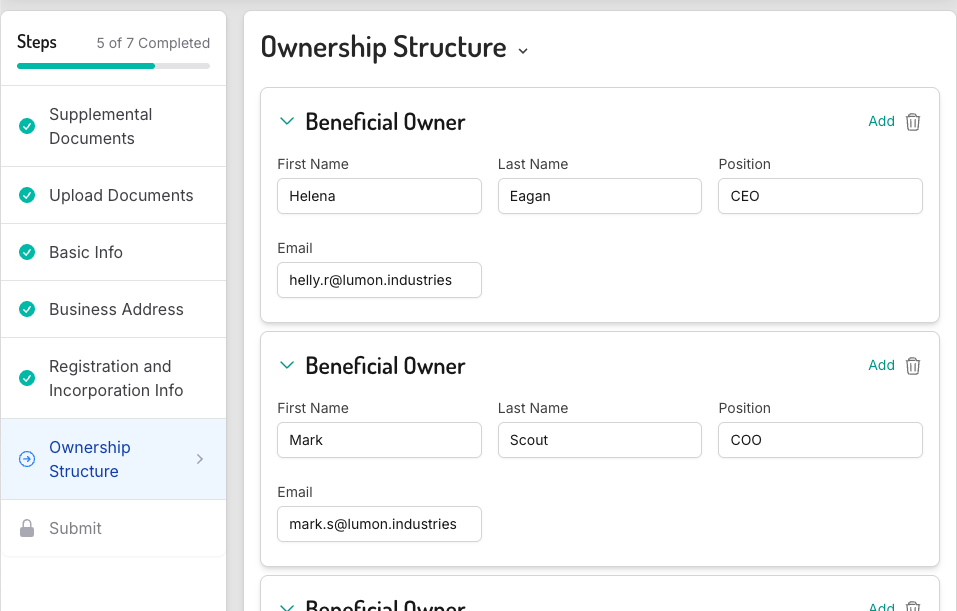

Identify UBOs

Automatically unwind complex corporate structures and invite Ultimate Beneficial Owners (UBOs) to complete KYC.

Ultimate Beneficial Ownership (UBO)

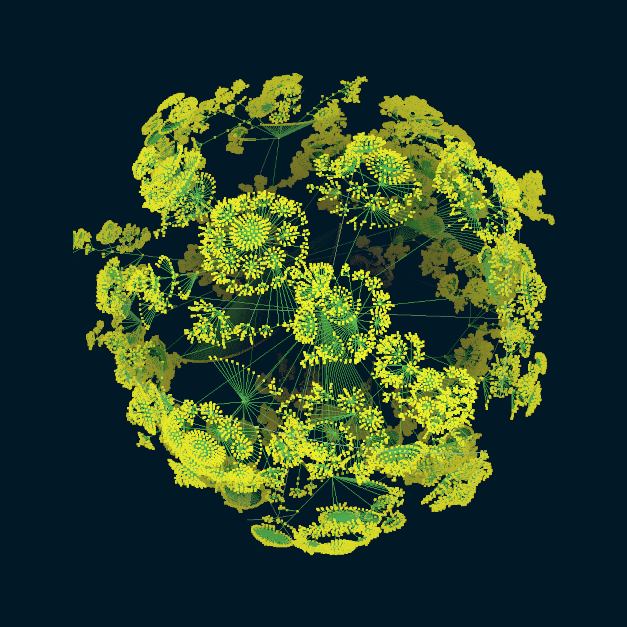

Uncover Complex Ownership Structures

Visually map and untangle complex corporate hierarchies.

Automatically calculate ownership percentages to identify UBOs.

Screen all identified owners and controllers against watchlists.

Invite UBOs via email to complete KYC using our self-service onboarding process.

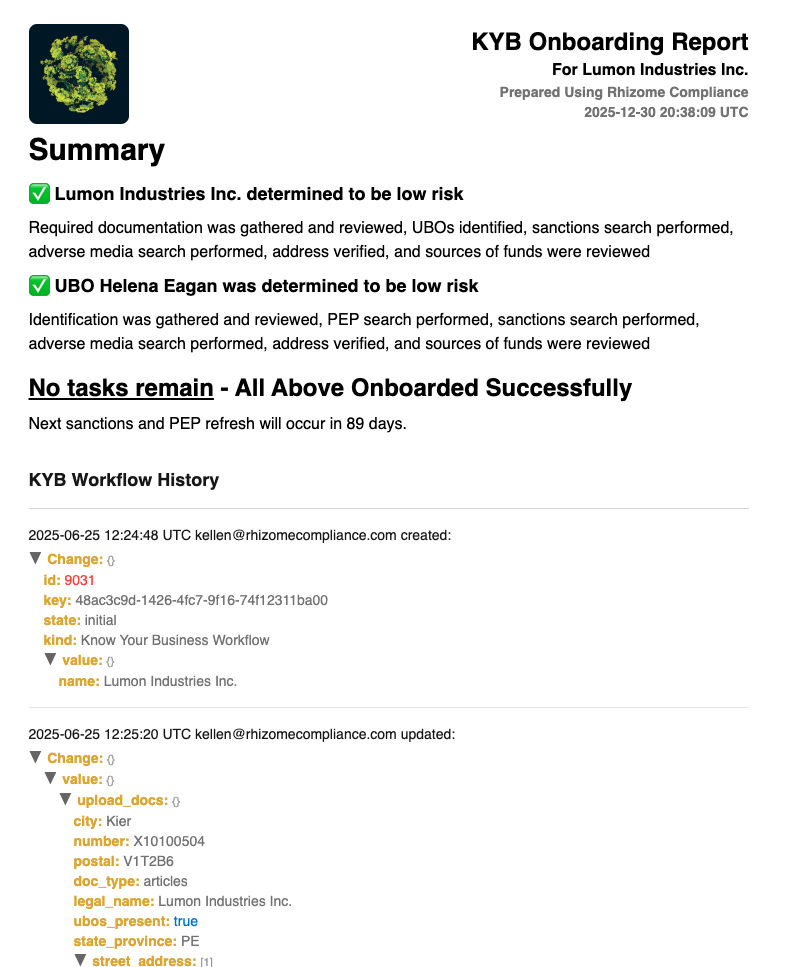

Maintain a clear, auditable record of your due diligence.

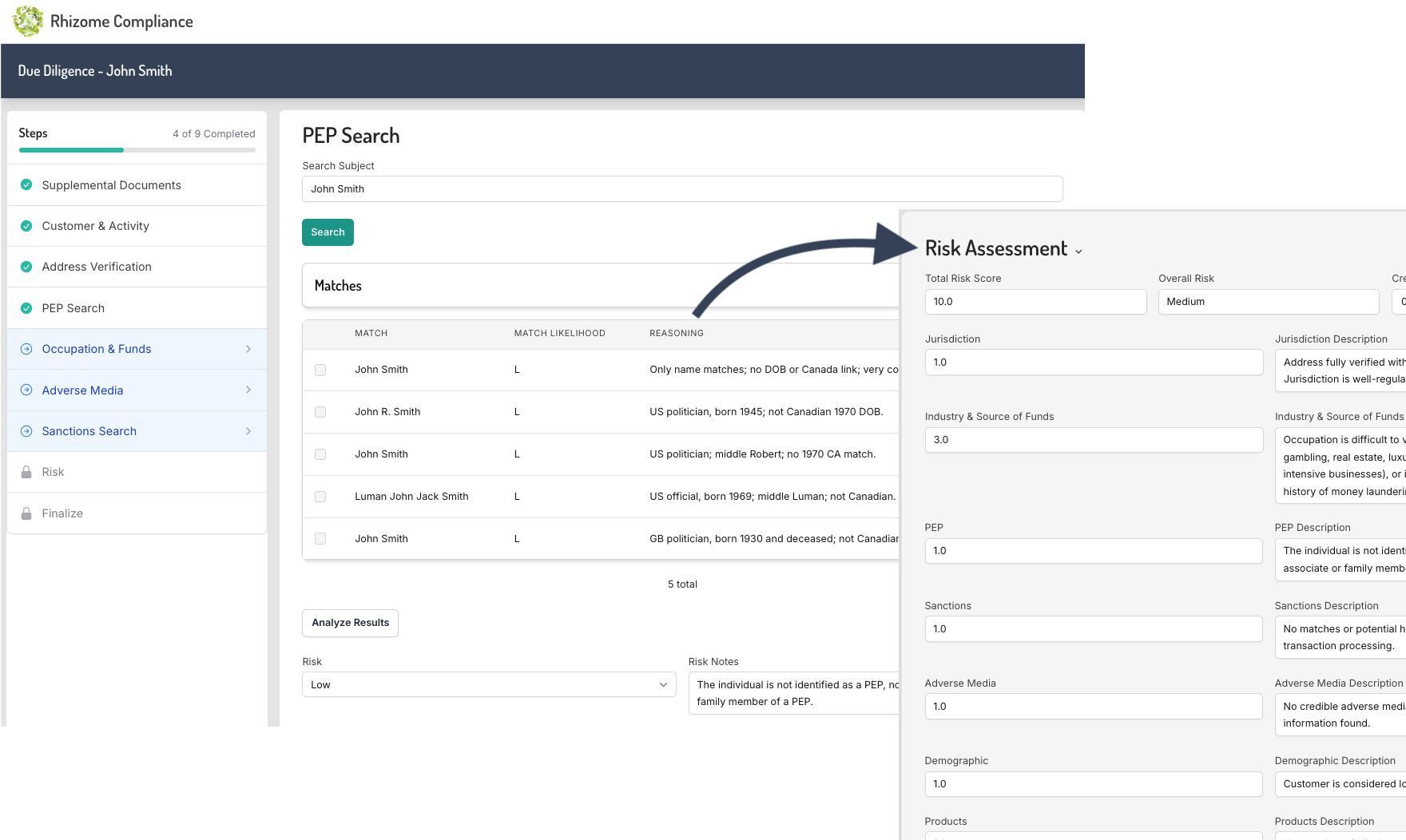

Risk Assessment & Monitoring

A Real-Time, Configurable View of Risk

Ready to Automate Your KYB Process?

Book a demo to see how Rhizome can help you onboard business customers faster and more securely.