Automated Know Your Customer (KYC) Software

Onboard customers in seconds

Streamline identity verification, automate due diligence, and prevent fraud with Rhizome's all-in-one compliance platform.

Real Time KYC Demo in Under Two Minutes

Manual KYC processes mean lost customers and mounting costs. Rhizome's KYC software automates the entire identity verification lifecycle, allowing you to onboard legitimate customers in record time while flagging high-risk individuals.

Stop losing customers to friction-filled onboarding. Our platform empowers your team to gather and retain all required data for a fully compliant Know Your Customer program, so you can focus on your core business.

With Rhizome you can accelerate growth without compromising on diligence

Key Features

- Rapid Identity Verification: Verify customer identities in seconds.

- Support Any Platform: Our web-based approach is supported on Android, iOS, and desktop.

- Advanced Fraud Prevention: Cutting-edge algorithms prevent sophisticated onboarding fraud before it impacts your business.

- Continuous Due Diligence: Get smart refresh reminders to ensure customer risk profiles are always up-to-date.

- Intelligent Risk Scoring: Transform client data into intelligent risk scores, and make defensible decisions in seconds.

- Audit-Ready Reporting: Generate detailed, automated reports that provide a clear audit trail of all KYC activities and decisions.

- Seamless Integration: Connect instantly with your existing CRM, ID providers, and internal systems using our flexible API or batch uploads.

How Our KYC Platform Works

Within seconds of a submission, our system verifies identity, performs fraud and liveness checks, and gets customers pre-approved.

From here you can start a due diligence workflow, or wait until thresholds are hit, based on your policies and risk.

All customers are placed into a continuous monitoring queue for automated, ongoing due diligence, so we're sure to remind you in the event that KYC data needs to be refreshed.

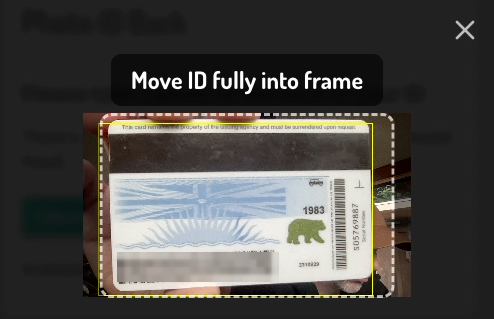

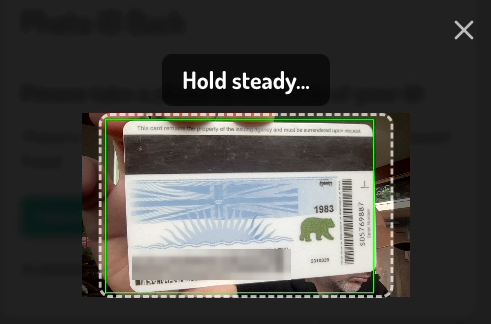

Robust Error Handling

See how our friction-free onboarding flows never leave customers stranded! (55 sec)

Multi-layered Fraud Detection

Multiple passes of configurable fraud detection protect your business. (1:07 sec)

Only Need KYC? We Can Do That.

While Rhizome offers a complete end-to-end AML compliance suite, we understand that every business has different needs. Our platform is fully modular.

Get just the components you need. Whether you're a startup looking for a fast, no-frills KYC solution or an enterprise needing to augment one part of your existing stack, we can provide KYC as a standalone, à la carte service. We want to grow with you.

Built for Your Industry and Country

Our flexible KYC solution is designed to meet the specific challenges of high-growth, regulated industries. We can also easily customize our workflows to gather additional data that is required for specific jurisdictions.

Global deployment options mean that data residency requirements can be met no matter where your customers are in the world.

Stop letting manual KYC processes slow down your growth and increase your risk. Schedule a demo to see how Rhizome can help you verify customers in seconds, automate screening, and build a truly compliant onboarding experience.